Nair: What exactly do do you think has actually avoided or slowed down a few of that it inside established highest banking companies? How does the opportunity your tapping into exist at all of the?

Gade: Getting smaller than average agile enjoys aided united states stay within the radar and you can adapt rapidly toward regulating conditions and tech advancements new business requires and demands. When it comes to large banking companies, whether or not they is money centers, worldwide banking institutions otherwise correspondent banking companies … whenever they venture into a new arena, it could cannibalize their unique providers. Including, marketplace lending might possibly be a risk for the credit card team of all of the of your higher credit card issuers.

This will be a good example of why they shied away from areas financing. Today, you actually see an enthusiastic alliance or realignment. Put another way, we ran regarding a level off disintermediation off financial qualities to help you a removal away from banking services. Banks is actually realizing … that there would be a different way of servicing and serving the fresh new users hence we ought to take a look at the fresh choices such industries lending, fintech and regtech and you will incorporate her or him, such as for example Goldman Sachs and you can Marcus [an internet program regarding Goldman Sachs providing zero-commission signature loans], as the a unique sorts of conducting business.

Such as for instance, higher home loan originators like Quicken Funds, Loan Depot and many others

Nair: Marketplace financing is unquestionably a location there is the most effective impetus inside – as you come the possessions have become past 50 % of a beneficial billion. For the larger banking institutions thinking about these alliances which you said, just how are you working with them to really make the associations much easier or more comfortable for her or him?

I would put them in two various other kinds. One to, the fresh new absolute fintechs, such as for instance Silicon Valley people … you to definitely spread out probably within the last less than six many years. These are typically Credit Bar, Upstart while others. I’ve several other classification, which is the heritage from boat loan companies that happen to be performing a phenomenal work on providing consumers from the individuals facets of the latest monetary tool providing. Very, i’ve two categories of elizabeth. You employ a bank in order to originate your own financing, deal with the fresh conformity together with percentage delivery toward users inside quasi-live.

Quicken Loans, particularly, was taking advantage of the fresh mil guides 30 days they are bringing for the financial origination top. Title of your own online game is how reasonable you might go when it comes to consumer order…. That is the huge competition ranging from many of these originators.

We, because the a lender, try right here to incorporate an assistance installment loan no credit check Austin, promote usage of percentage routes and conformity modules, so you’re able to whoever really wants to head to one business. He’s a little bit of a base right up there.

This is why financial institutions that will be throughout the mastercard room have too much to gain because of the going towards this provider by giving another kind of loan on users. At present, for folks who walk into a bank branch and you can complete an software, if you don’t use the internet and you can fill out an application having good charge card, it could take ranging from less than six weeks for you to acquire a response.

We think that history players such as for example Multifunding, plus Quicken Money and you may Mortgage Depot, features a compliance structure and know conformity requirements much better than other people

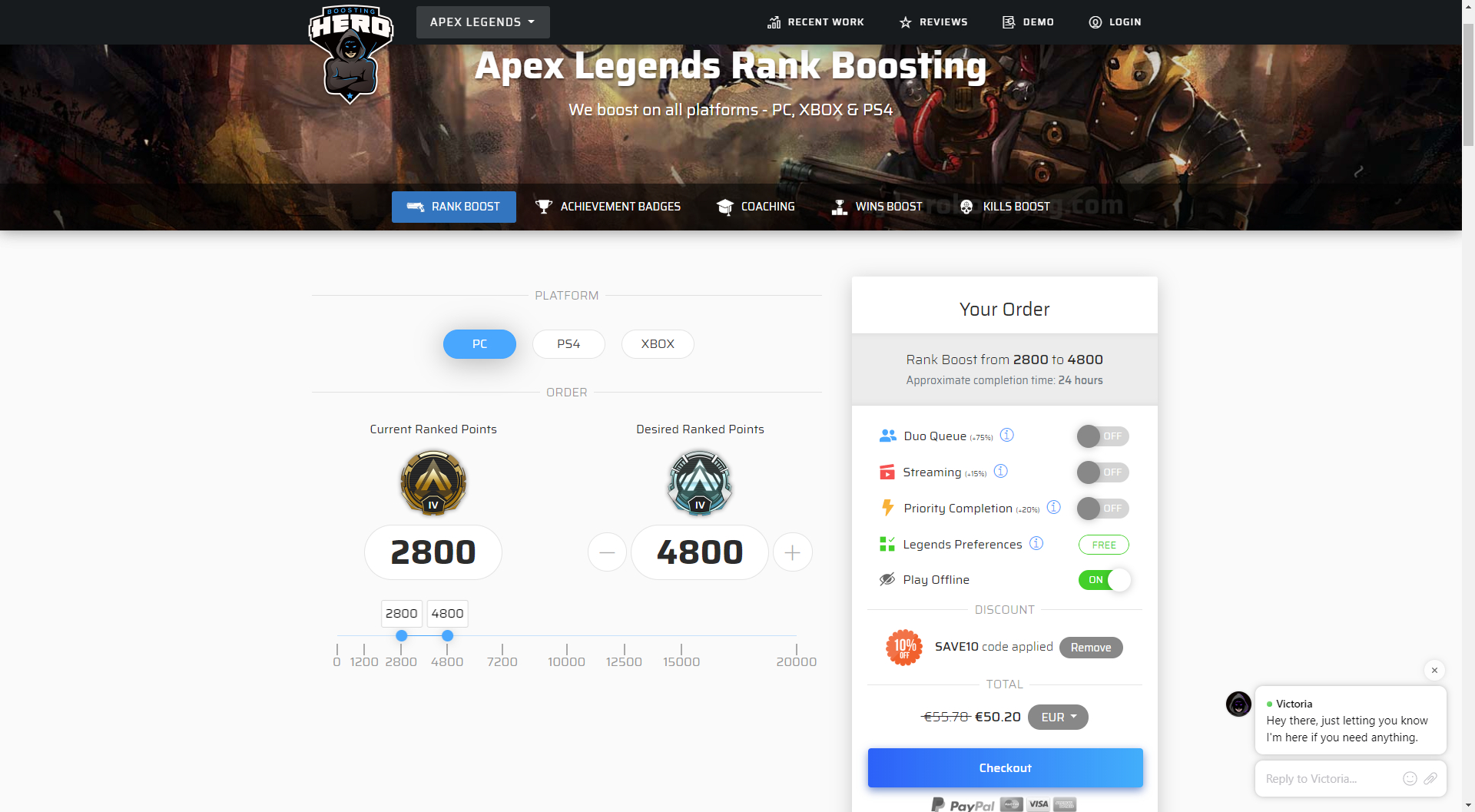

The user may be worth definitely better. The fresh fintech organizations with the industries credit front offer a help birth one people deserve, nowadays anticipate now. The borrowed funds app discover seamless and elegant. You will have a response inside twenty minutes, while the technology enables you to definitely. And you will in this twenty-four to 2 days, you will have the funds in your membership.

Leave A Comment